Media Hub

Show Me:

-

News

Acting workshops from January until March 2026

ACTING WORKSHOPS starting JANUARY 2026 Further Than The Edge Productions are running Open Level Acting Workshops for adu...

-

News

Our reception will be closed for the rest of today and will return to normal service on Monday, 22 December

Our reception will be closed for the rest of today due to staff shortages and will return to normal service on Monday, 2...

-

News

Contractors and Colleagues come together to support 75 households this Christmas

A huge thank you to our brilliant contractors – Keystone Fire Safety, Watret, McIntyre, Gilmartins, John O’ Conner, CBS ...

-

Blog

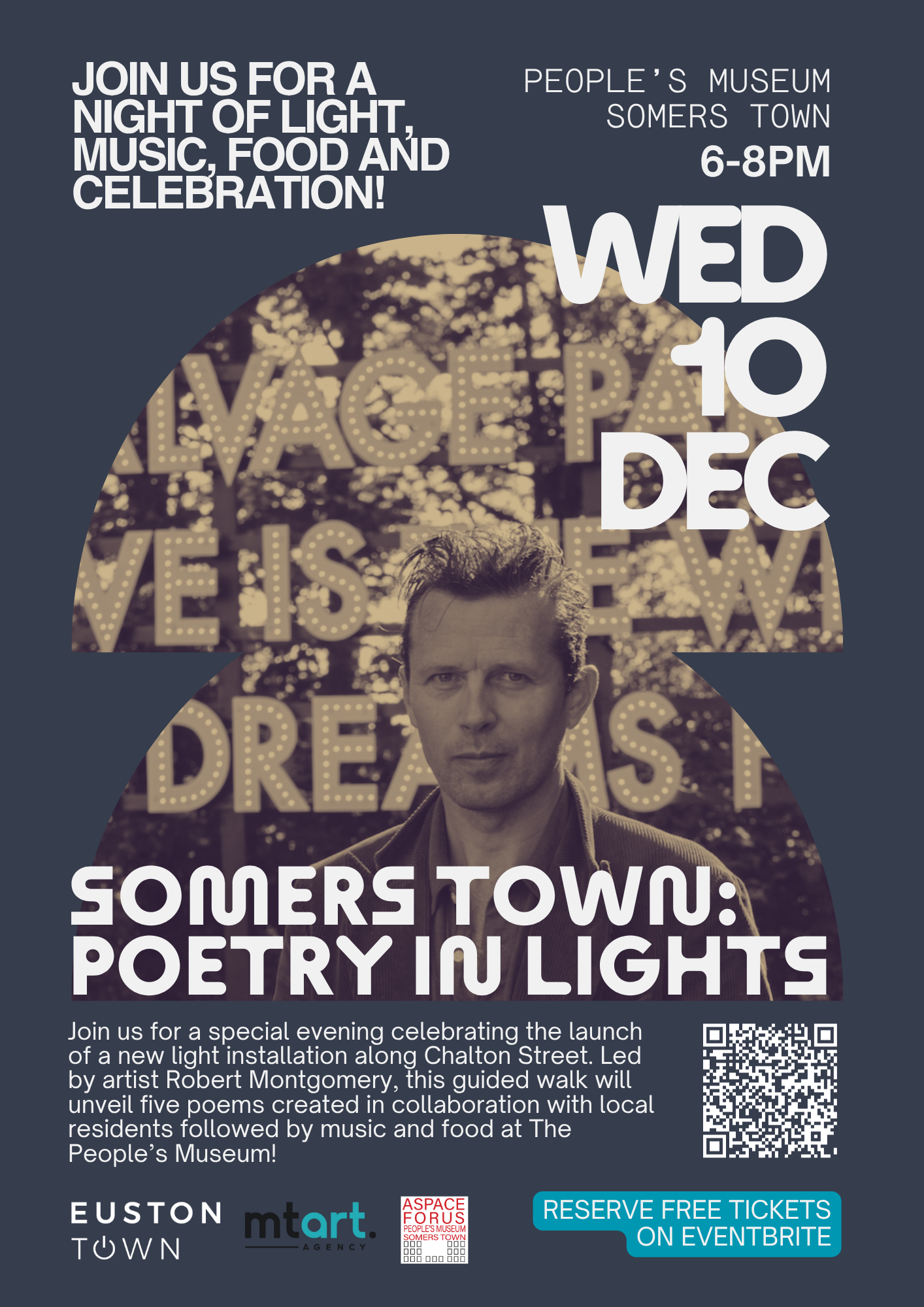

People's Museum Christmas Party! Poetry in Lights

Christmas Party! Poetry in Lights Food & Live Music December 10, 6–10pm On Wednesday 10 December The People's Mu...

-

News

Our Customer Resolution Team will be unavailable from 3-6pm on 10 December

Our Customer Resolution Team will be unavailable from 3-6pm on 10 December, so please log any queries by emailing enquir...

-

News

Transfer of Engagements - Resident Consultation next steps and FAQs

Resident Consultation on the Transfer of Engagements Thank you to everyone who took part in our recent consultation. The...

-

News

Our Annual Report to Tenants 2024/25

Our Annual Report to Tenants 2024/25 gives an overview of what we have achieved throughout the year, focused on what mat...

-

Blog

White Ribbon Events supported by Enfield Council

“White Ribbon is the UK's leading campaign engaging men and boys in the fight against gender-based violence. This year...

-

News

Our festive opening hours for 2025

Our Christmas and New Year Opening Hours Over the festive period, our teams will still be here to help you — but some of...

-

News

Come along to our festive family event on 5 December from 3.30-6.30pm

Please come and join us at our fun filled, free Winter Event for families on 5 December atBasil Jellicoe Hall, Drummond ...

-

Blog

Sim racing at young people aged 14+ Activity Centre in Camden

I currently volunteer in a Youths Activity Centre in Camden. We currently welcome youths from Camden to use our motorspo...

-

News

Resident Consultation for Transfer of Engagement

Consultation on Transfer of Engagements (merging Origin Housing Limited into Places for People Living+ Limited) In Apr...

-

News

Changes to Housing Transfers

We are making some changes to the way we manage requests to move - housing transfers. Origin’s transfer list has operate...

-

News

Celebrating Black History Month 2025: Standing Firm in Power and Pride

We are proud to support Black History Month UK 2025, which takes place during October under the theme “Standing Firm in ...

-

News

Our annual complaint performance 2024/25

The Annual Complaints and Service Improvement Report is an annual regulatory report that requires landlords and housing...

-

Blog

Somerstown art heritage trail

Newly launched in September is a fascinating art heritage walking trail in the heart of Somerstown - artineverydaylife....

-

News

Launching the Art in everyday life Heritage Trail

A new heritage trail is coming to Camden this September. It’s the first new artwork for 100 years on Somers Town - look ...

-

News

A day in the life of our Caretaker, James

Our cleaning and caretaking teams work hard in all weather to ensure your estates are as clean and well maintained as po...

-

News

Our grounds maintenance service during the Summer and Winter months

We provide a Grounds Maintenance Service in partnership with our contractor John O’Connor.Our partnership with John O’Co...

-

News

Our Enfield Single Housing Office is closed today (21 August 2025)

Due to staff sickness Our Enfield Single Housing Office is closed today (4 August 2025). Please report any repairs or lo...

-

News

Planned maintenance for your homes

Over the last couple of years, we have enhanced our knowledge of the condition of your homes. This improved information ...

-

News

Budget Bytes: Affordable Broadband Options

Since 2020, Origin has been working with Internet Service Providers (ISPs) to install fibre networks in our buildings. S...

-

News

Origin Housing are offering free activities for young people aged 11-16!

We are offering free activities for young people aged 11-16 throughout the Summer. Get creative with T-shirt printing or...

-

News

St Anne's flats gets a new garden space

We’ve recently worked with our Grounds Maintenance partner, John O’Connor, to improve a part of our St Anne's estate. Th...

-

News

Join us for our Summer resident event on 25 July at Basil Jellicoe Hall

Come and join us to meet with colleagues from across Origin, explore different stalls, enjoy some free food and children...

-

News

Help with school uniform costs

Although, schools have yet to finish for the summer, some local Councils have opened their application process for help ...

-

Blog

Anti-social behaviour Awareness Week 30 June to 6 July 2025

We are proud to stand with organisations across the UK in support of ASB Awareness Week 2025, a national campaign runnin...

-

News

A Message from Victoria Hall Harrow's CEO: Supporting Our Community in Harrow

Hello Origin Housing residents, I'm Troy, the CEO of Victoria Hall Harrow a community Hub located beneath Byron Cou...

-

News

Our Community Fund re-launches on 30 June, plan your application today to make a difference in our communities!

The Sixth year of Origin’s Community Fund will be launched on Monday 30 June 2025 to support our communities in London a...

-

News

Watermill Lane, Enfield gets a brand new playground – just in time for summer!

Our Customers at Watermill Lane will be enjoying a brand new playground this summer, thanks to some brilliant teamwork b...

-

News

Getting to know you

We are working on a ‘getting to know you’ survey, so are asking you to complete a survey that will tell us a little m...

-

News

Camden Council’s Children’s Services have been rated ‘outstanding’ by Ofsted, placing Camden as one of the best performers in the country for a second time.

Ofsted praised Camden's Children's Services for this consistent and impactful approach, noting that children in care "co...

-

Blog

Coming soon - London Festival of Architecture

As part of the London Festival of Architecture, join Camden Highline and Urban Learners for a hands-on, activity-packed ...

-

News

Find out more about Asbestos, it's important everyone knows the basics

What is Asbestos? Asbestos is a natural mineral fibre that was widely used in construction and manufacturing from the e...

-

News

St Anthony's statue blessing

On 8 May, we held a blessing with Father Paschal, and the Somers Town History club, for the newly restored St Anthony’s ...

-

News

Mental Health Awareness Week 2025

Since 2001, the Mental Health Foundation has been leading Mental Health Awareness Week - bringing the UK together to foc...

-

News

A year of being with Places for People

On the 16 April 2024 we legally completed our merger with Places for People. Since we have now been part of the Places f...

-

News

#ChargeSafe: e-bike and e-scooter safety advice

Whilst e-bikes and e-scooters offer a great way round the city, if the batteries become damaged or begin to fail they ca...

-

News

Update: Eversholt Street reception is open again

We've completed the maintenance work for our Eversholt Street reception and are happy to announce that it is back open a...

-

News

Domestic abuse support

Domestic abuse happens when someone close to you (usually your partner or family member) behaves towards you in a way th...

-

News

Calculating rent and service charges and financial help available

Each year we review your rent and service charges to ensure we can continue to invest in our homes, provide essential s...

-

News

Origin Board steps down

In April last year when we became a subsidiary of Places for People, we agreed that our current Board would step down af...

-

News

Our Customer Resolution Team are unavailable between 2-4pm on 26 March

Our Customer Resolution Team are unavailable between 2-4pm on 26 March. Please email enquiries@originhousing.org.uk or c...

-

News

Planned improvements to your homes

One of the main reasons behind Origin’s merger with Places for People was to get more investment into your homes, and as...

-

Blog

Going Beyond homes

Going “Beyond Homes” – how social housing providers can answer the Government’s call to address the housing crisis and m...

-

News

Big Sister Programme: Championing rights, equality, and empowerment for girls

As the world marks International Women’s Day under the banner of Rights, Equality, Empowerment, Places Leisure is proud ...

-

News

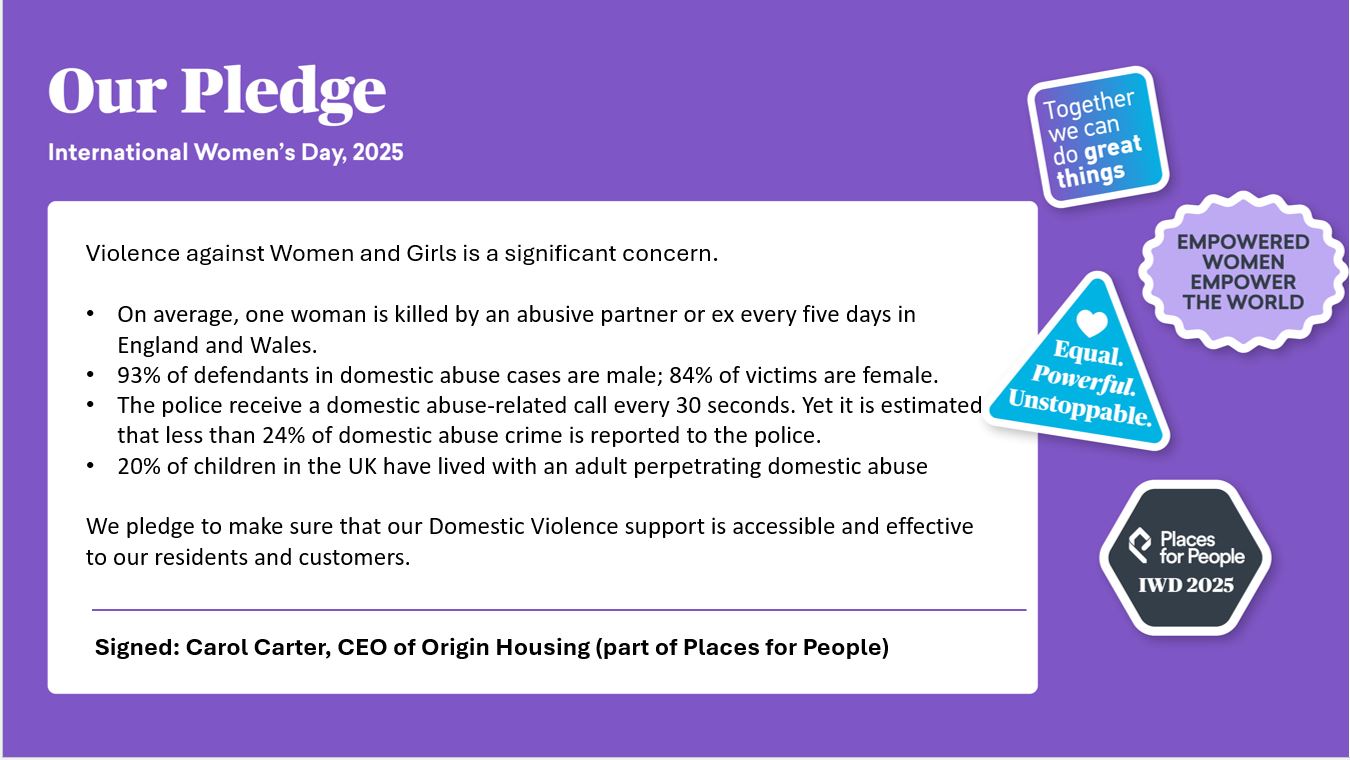

Our Pledge: International Women's Day, 2025

Our Pledge for International Women's Day 2025. Violence against Women and Girls is a significant concern. •On averag...

-

News

Out and about with Carol (1)

This month I had the opportunity to briefly visit two buildings in Somers Town – Levita House and Unity Mews – with Neig...

-

Blog

Camden Highline spring update

The Interchange building in Camden Lock is a Grade II-listed red brick warehouse and has been a focal point of our resea...

-

News

PfP and Origin colleagues meet residents in Kings Cross

On a beautifully sunny day in February Origin took colleagues from Places for People (PfP) Board and Executive team on a...

-

News

Places for People visit some our Care and Support schemes

Last week, we gave four of our PfP colleagues a whistle stop tour of our schemes. Christine Candlish, Caroline Terry, K...

-

Blog

Out and about with Carol Jan 2025 Watson Court

Yet again I managed to pick a currently rare and beautifully sunny day to visit the home of the Hornets (AKA Watford Foo...

-

Blog

Join us for talk by author and historian Carol Harris at the QE2 Centre, Coram Campus, 6 February.

Thursday 06 February 2025 6:30 PM - 9:00 PM QE2 Centre, Coram Campus, 41 Brunswick Square WC1N 1AZ Join us for networkin...

-

News

Christmas opening times:

Over Christmas we will be closing at 4pm on 24 December and then closed on 25 and 26 December and 1 January 2025. If you...

-

News

Celebrating 100 years: Our resident’s story from stage to community champion

We are delighted to share the incredible story of one of our residents, John Levitt, a resident of Holsworthy Square sin...

-

News

Our Contact Centre will be closed from 1pm on 12 December and re-open at 8am on 13 December

Our Customer Resolution Team will be unavailable from from 1pm on 12 December until 8am on 13 December. You can still fi...

-

News

Celebrating 100 years - Olga Blackman

Olga Florence Blackham, born in 1896, was in the first committee of the Ethical Union Housing Association, later to chan...

-

Blog

Athlone residents coffee afternoon

Join our Athlone residents for a Mental Health Coffee afternoon on 4 December. 12-2pm at Athlone Community Hall. 135 Ath...

-

News

Places for People integration update

Following the announcement of our merger in April 2024, we would like to update you on what has been happening over the ...

-

News

It's our Winter event 12 December at 4pm

Come along to our free Winter Event for families on 12 December at Basil Jellicoe Hall, Drummond Crescent, London NW1 1L...

-

News

Our Annual Report to Tenants 2023/24

Our Annual Report to Tenants gives an overview of what we have achieved throughout 2023/24, focused on what matters most...

-

News

Congratulations to our winners at the Places for People Community Awards 2024

Each October, Places for People gather in York to honour the exceptional efforts of those who have made a real differenc...

-

Blog

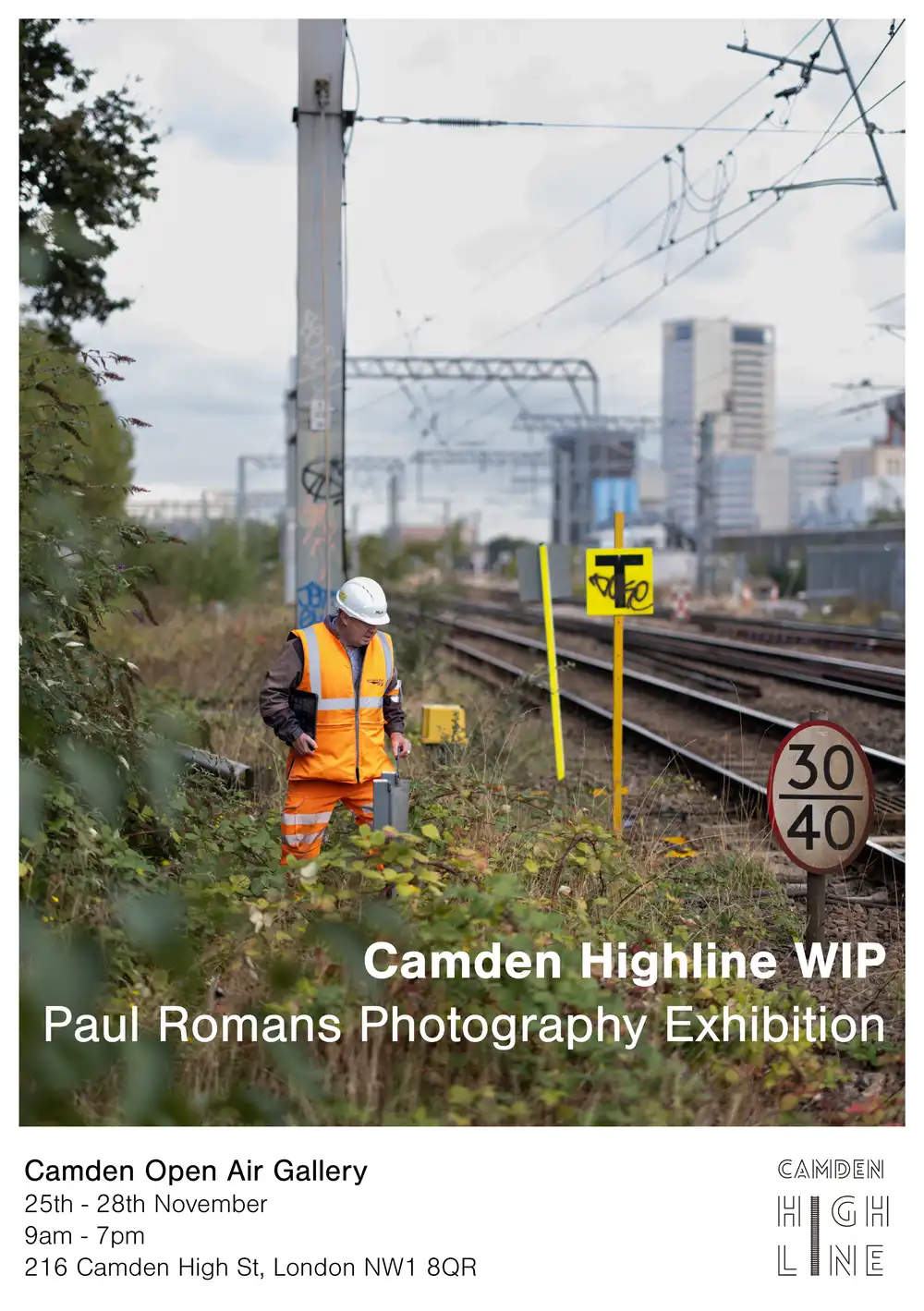

Camden Highline Exhibition

Camden Highline WIP Paul Romans Photography Exhibition Camden Highline WIP offers a behind-the-scenes look at the charit...

-

News

Celebrating our founders - Father Percy Maryon-Wilson

Father Percy Maryon-Wilson was an original member of the St Pancras House Improvement Society, later known as St Pancras...

-

Blog

Out and about with Carol October 24

Towards the end of October I took a stroll from Belsize Park tube station down Haverstock Hill to visit our retirement s...

-

News

Rapid Review Scrutiny Group - we are recruiting!

We have an opportunity for you to join our new Rapid Review scrutiny group. Being a member of the Rapid Review scrutiny ...

-

News

Happy Diwali 2024

Diwali, known as the Festival of Lights, is one of the most celebrated festivals across South Asia and beyond, symbolizi...

-

News

Fitch credit rating reaffirmed as A- with a stable outlook

This week our credit rating agency, Fitch, in their annual review of Origin, made the decision to revise Origin’s credit...

-

Blog

How to save money on your energy bill this winter

With rising energy prices and colder weather, we need to prepare for higher energy bills. From turning on the heating to...

-

News

Apply now for our latest round of Community Funding - closing in April 2025

The fifth year of Origin’s Community Fund will be launched on Monday 21 October 2024 to support our communities in Londo...

-

News

Local fire rescue visit at Columbus Close

As part of our continued working partnership with local fire authorities, Hertfordshire Fire and Rescue Service attended...

-

News

PfP Executive team visit our award winning Young People's Service

The Places for People Executive team holds listen and learn sessions as part of their meetings. This is where they visit...

-

News

Explore Black History Month events

There are plenty of free events happening across London to celebrate Black history and culture: London Museum Docklands...

-

News

The latest Camden Highline newsletter September 2024

Take a look at the latest Camden Highline newsletter below: camdentownunlimited.cmail19.com/t/i-e-ffvtl-tdiiouhli-n/

-

News

Black History Month 2024: Reclaiming Narratives

This year's Black History Month theme, "Reclaiming Narratives", focuses on honouring the stories and legacies that have ...

-

News

A great trip to the seaside for our older residents, despite the weather misbehaving

Our Retirement Housing Team recently organised a coach trip down to the seaside at Folkestone. Even though the typical B...

-

News

We support Fire Door Safety Week

At Origin Housing, we are proud to support Fire Door Safety Week as part of our ongoing commitment to keeping our reside...

-

News

Young People Service Summer Social event

A couple of weeks ago, our Young People Service team held a Summer Social event. The day saw 15 young people join in, al...

-

News

The Latest Somers Town Community Newsletter Sept/Oct 2024

Take a look at the latest Somers Town Community Newsletter, covering topics from reducing food waste to local events by ...

-

News

Our reception and Customer Resolution Team phone lines will be closed tomorrow, 20 September 2024

Our reception and Customer Resolution Team phone lines will be closed tomorrow, 20 September 2024. Our Repairs line will...

-

Blog

Celebrating 100 years. We hear from our previous General Manager, Norman Goldsmith

We recently received congratulations from Norman Goldsmith for our 100th anniversary. Norman was our General Manager dur...

-

News

Camden Council Community conversation events

Camden Council will be hosting two events this month to hear from Community members and residents about housing delivery...

-

News

Are you over State Pension age, or know someone who is?

Pension Credit tops up pension income and can help with day-to-day living costs. If you are over State Pension ...

-

News

Our planned investment programme

One of the main reasons behind the merger was to get more investment into your homes and these are the headlines for our...

-

News

Join us for activities at Basil Jellicoe Hall

We're excited to invite our older residents to join us for some wonderful activities at Basil Jellicoe Hall. Chair-Based...

-

Blog

Somers Town: the Housing Story

14 September from 12pmPeople's Museum, 52 Chalton St NW1 1ES to St Mary's Church, NW1 1BN SAVE SOMERS TOWN - Can you hel...

-

News

Celebrating our founders - Ian Hamilton

Ian Hamilton was the key architect for St Pancras House Improvement Society. Father Jellicoe got him on board to help t...

-

Blog

Out and about with Carol - August 2024

This month I was delighted to join our community event at Magpie Close in Enfield where our resident and community engag...

-

News

New homelessness campaign launched by Brent Council

On Friday, 23 August, Brent Council launched the "Find a Place You Can Afford" campaign to highlight the severe homeless...

-

News

A Day at the seaside: residents enjoy sun, sea, and community

Our recent day trip to the coast proved to be a huge success, bringing together 17 residents from Camden and Chelmsford ...

-

News

Summer celebration for our residents at Basil Jellicoe Hall

On 26 July, we hosted our Annual Summer Resident event at Basil Jellicoe Hall in Camden. The event had a great turnout o...

-

News

A Day to Remember at Columbus Close celebrating 100 Years of Origin

To mark Origin’s 100 year celebrations the team at Columbus Close, one of our supported housing schemes, hosted a speci...

-

News

We made the decision to step away from X/Twitter

Today is the right time for Origin Housing to come off of X. We feel that by being present we are aiding the organised ...

-

News

Join us for our Summer Family Event on 22 August at Magpie Close

Join us at our free Summer Family Event on Thursday, 22 August from 3pm - 6pm at Magpie Close, EN1. There will be food,...

-

News

Our reception will be closed for the rest of today and tomorrow and will return to normal service on Monday, 12 August.

Our reception will be closed for the rest of today and tomorrow and will go back to normal service on Monday, 12 August....

-

News

Hope not hate: A view on the riots going on across the country

We at Origin utterly condemn the racist thuggery, intimidation and extreme violence we have seen across the country in r...

-

News

Celebrating our founders - Nora Hill

Nora Hill was one of the founding committee members of the St Pancras House Improvement Society, later known as St Pancr...

-

Blog

Out and about with Carol - July 2024

At the end of July I donned my sensible shoes again (to be fair that is pretty much all the time these days) and set off...

-

News

New development: Lantern Apartments, Hampstead Road NW1

We recently took handover of six two and three bed affordable rent apartments at The Lantern in development in Camden on...

-

News

Join us for our Summer resident event on 26 July 2024 from 3-6pm at

Come and join us to meet with colleagues from across Origin, explore different stalls, enjoy some free food and children...

-

News

Investing in your homes

We carry out condition surveys on our homes to show us when we need to carry out improvement works, based on the age of ...

-

Blog

Out and about with Carol June 2024

In the last couple of months, I’ve been fortunate to be part of two events designed to increase our visibility and conne...

-

News

Team work makes the dream work - volunteers restore community garden

Our Community Engagement Team organised a volunteer day to bring a previous award winning community garden in Camden bac...

-

News

Celebrating 100 years - Ted Willis

Playwright, novelist and screenwriter, Edward Henry Willis, commonly called Ted Willis, was President of the Humanist H...

-

News

A new start at Novella: One of our new residents, Richard, tells us his inspiring story about moving into his home

One of our new residents at Novella, Richard tells us his inspiring story about moving into his home How do you feel a...

-

News

Don’t forget to vote in the General Election this Thursday 4 July

Don’t forget to vote in the General Election this Thursday 4 July How to vote: Voting in person - GOV.UK (www.gov.uk) Y...

-

News

Congratulations to our Housing Heroes award winning ‘Team of the year’

Congratulations to our Housing Heroes award winning ‘Team of the year’ Our Young People’s service were really proud to h...

-

Blog

Celebrating 100 years - Father Nigel Scott

Father Nigel Scott joined St Pancras House Improvement Society in 1929 and he was Father Basil Jellicoe’s Assistant unti...

-

Blog

Out and about with Carol - May 2024

This month I travelled to the quirkily named Turkey St station in Enfield for a visit to Larmans Road where we own and m...

-

News

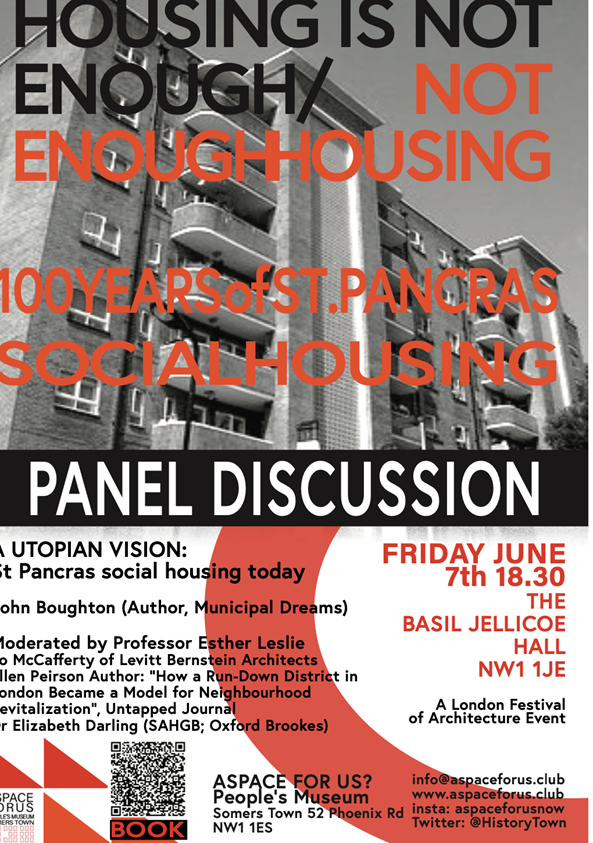

A People's Museum Somers Town Panel Discussion on Friday 7 June

Meet A People's Museum Somers Town Panel Discussion on housing issues this Friday 7 June at 6.30pm at Basil Jellicoe Hal...

-

Blog

Security where you live

Your feedback tells us that the security of where you live is really important to you. You have told us that ASB from in...

-

News

Happy Pride Month 2024

We’re proud to celebrate the LGBTQI+ community’s right to love, respect, freedom and equality. 🌈 History of Pride Month...

-

News

We're looking for residents to join the Places for People National Customer Group

This opportunity to join the National Customer Group is only available to Origin Housing customers who are currently ren...

-

News

Blue Plaque for Irene Barclay

Yesterday, one of our founders, Irene Barclay was celebrated with a Blue Plaque from English Heritage. Irene Barclay bec...

-

News

People's Museum Somers Town centenary programme and more

St Pancras Housing Centenary 100 years ago the St Pancras Housing Society set down a visionary example for rebuilding a...

-

News

Installation of road markings on Eversholt Street

From 22 until 24 May 2024 between 9pm and 5am (daily), Mace Dragados will undertake road markings at two locations on Ev...

-

News

We have been shortlisted for First Time Buyer Readers’ Awards 2024

We are delighted to announce that we have been shortlisted in the Best Marketing Campaign for our Origin Kickstart camp...

-

News

The Support Hub – Our Helping Hand

Our mantra ‘housing is not enough’ is exemplified in the work of the Support Hub. Since its inception on World Mental He...

-

News

We’ve upgraded our website!

We’ve upgraded our website! We hope you like the new look and feel. There’s still of all the information on there that ...

-

News

Celebrating 100 years - Irene Barclay

Irene Barclay became the first qualified woman Chartered Surveyor in 1922, after the Sex Disqualification Removal Act ha...

-

News

Collaboration in action at our retirement scheme, Pennethorne House

Colleagues from across Origin, alongside contractor Quinn London held an engagement meet and greet event with our retire...

-

News

We have been shortlisted for Housing Heroes Awards!

We are delighted to announce that we have made the Housing Heroes Awards 2024 shortlist for Team of the Year – 1,001-15,...

-

Blog

Out and about with Carol - April 2024

This week, on a crisp sunny morning, I joined our longstanding and valued member of the estate services team, Albert But...

-

News

Origin Housing joins Places for People

Today marks a significant milestone for the future of Origin as we have successfully completed our merger with Places fo...

-

News

Celebrating 100 years - Father Basil Jellicoe

Father Jellicoe, born in Chailey, Sussex, in 1899, was the son of an ordained priest. After graduating from Magdalen Col...

-

News

New annual Rent Charges – how to provide the new rent to Universal Credit

On your Universal Credit Journal please do not use the 'Change of circumstances' to-do, to report an annual rent change...

-

News

Ramadan Mubarak!

Today, thousands of Muslims begin to fast and will do for the next four weeks to mark Ramadan. Ramadan is at a different...

-

Blog

Out and about with Carol - Feb 2024

The rain had a rare day off during my estate visits in February which took me to three different schemes in the heart of...

-

News

Celebrating our founders - Mora Burnet

Mora Burnet was crucial to the establishment of the Ethical Union Housing Association. She was among a group of Ethical ...

-

Blog

A year with Origin

On 27 February 2023, 152 homes joined Origin from L and Q. We wanted to make sure that everyone felt welcomed and listen...

-

News

How our residents views are helping us deliver our next grounds maintenance contract

We recruited residents to work alongside us in a ‘Scrutiny Rapid Review’ to look at our grounds maintenance contract and...

-

Blog

A history of Origin in Enfield

Chief Exec Adrian Norridge Adrian who recommended expanding into Enfield in 1987. There had been a surge in homelessness...

-

News

Places for People merger approved - resident update

Following a recommendation from Origin’s Board, taking into account feedback from residents in the consultation period, ...

-

Blog

People's Museum Somers Town - Centenary Open Meeting

People's Museum Somers Town are calling out to writers, artists, contributors, guides and more for a centenary open meet...

-

News

Origin Housing’s merger with Places for People approved

Origin Housing, which owns and manages over 7,800 homes across London and Hertfordshire, is set to become a subsidiary o...

-

News

Feature on our founder - Adrian Norridge

Born in 1943, Adrian Norridge was very active in housing, with a number of different positions in his long career in the...

-

Blog

The latest Somers Town Community Newsletter - February 2024 HU

Take a look at the latest Somers Town Community Newsletter, covering topics like Time to Talk Day, cycle lessons for wom...

-

Blog

New National Housing Federation Report - Let's fix the housing crisis

The National Housing Federation has launched a new report, Let’s fix the housing crisis: delivering a long-term plan for...

-

Blog

End youth homelessness petition

New Horizon Youth Centre needs your support.Last year 136,000 young people approached their council as homeless but the ...

-

News

Record number of women to be celebrated with English Heritage blue plaques in 2024

English Heritage has announced that this year a record number of women will be celebrated with blue plaques including Ir...

-

Blog

People's Museum Somers Town - Reopening!

The People's Museum Somers Town will be reopening tomorrow on12 January 2024and will be celebrating100 Years of St Pancr...

-

News

We're celebrating our 100 year anniversary!

Over the course of the year, we will be sharing good news stories from teams, showcasing what we do day to day, the impa...

-

Blog

People's Museum Somers Town - A year review

The People's Museum Somers Town have had their first full year as a museum and as the year is coming to an end, they hav...

-

News

Our Annual Report to Tenants 2022/23

Our Annual Report to Tenants gives an overview of what we have achieved throughout 2022/23, focused on what matters most...

-

News

Places for People - Consultation update

The six-week resident consultation period came to end on 7 December and we wanted to share the feedback we have received...

-

Blog

Resident Winter event in Camden 2023

The Resident and Community Engagement team held a Winter Event for residents at Basil Jellicoe Hall on 8 December 2023. ...

-

News

Regulator of Social Housing announcement

The Regulator of Social Housing has announced that Origin’s governance and financial viability grading has been reduced ...

-

News

Our festive opening hours 2023

As we have done for a number of years now, we are staying open between Christmas and New Year. On Friday 22 December we ...

-

News

Update on our grounds maintenance contract

To help us award a new contract for the company that looks after gardens and open spaces around our blocks we asked you ...

-

Blog

Charity Light Show

One of our residents, Mark, turned on the lights for his annual charity light show. Mark along with family and friends h...

-

News

FREE Winter Event for families on 8 December at Basil Jellicoe Hall

Come along to our FREE Winter Event for families on 8 December at Basil Jellicoe HallPlease come and join us at our fun ...

-

News

Please help us keep your building as secure as possible and ensure you close doors behind you

Please help us keep your building as secure as possible and ensure you close doors behind you.We are working in partners...

-

Blog

We're a Best Companies One Star organisation!

Best Companies are workplace engagement specialists, they help organisations like Origin become better places to work b...

-

Blog

Festive period As part of electrical safety week, Origin have lined up our top tips for a safe Christmas!

Christmas lights brighten up homes across the UK but can be an electrical safety risk. Give the lights a break - switch ...

-

News

Origin Housing and Places for People merger - Resident information

Announcement 19 October On the 19 October we announced that we have entered into merger talks with national Housing Asso...

-

News

Merger consultation frequently asked questions

The consultation ran until the 7 December. From the sessions we have developed an FAQS, these answer the most common the...

-

Blog

Out and about with Carol - November 2023

We managed to find a rare break in the seemingly incessant rain to go on our walkabout in Somers Town last week which we...

-

News

Government support available for cost of living

Following two Cost of Living Payments totalling up to £650 in 2022, millions of households are continuing to receive fur...

-

News

Fitch Credit Rating update

This week our credit rating agency, Fitch, in their annual review of Origin, made the decision to revise Origin’s credit...

-

News

'The Walled-Up Woman' and other events at The People's Museum in Camden

Bonfire night event: The Walled Up Woman The Walled-Up Woman, 5 NovemberJoin The People’s Museum Somers Town on Bonfire ...

-

News

Origin Housing and Places for People in merger discussions

Origin Housing and Places for People in merger discussions Origin Housing and Places for People are pleased to announce ...

-

Blog

Healthy Homes

Our first priority and responsibility as a landlord is to provide you with a safe and healthy home.If you are currently ...

-

News

Origin's In Depth Assessment (IDA) update

The Regulator of Social Housing has today, following an In Depth Assessment, put our governance and viability gradings u...

-

News

Black History Month 2023

Black History Month 2023 recognises and celebrate the invaluable contributions of black people to British society. Black...

-

News

It's Fire Door Safety Week

This year, Fire Door Safety Week will run from Monday 25 September until Friday 29 September. For more information check...

-

News

Share your views with the Regulator of Social Housing

The Regulator of Social Housing is seeking views on its revised regulatory consumer standards. These are standards that ...

-

News

Our summer events

The events were held in Camden, Edmonton and Harrow and organised by the Resident and Community Engagement Team.There wa...

-

News

Unacceptable Behaviour Policy Feedback

We are currently reviewing our Unacceptable Behaviour Policy and would like your feedback on this. Our Customer Resoluti...

-

News

Out and about with Carol Carter

Armed with my sunnies, sunscreen and bottle of water and of course umbrella and cardi (just in case) I arrived at our br...

-

News

Tenancy fraud is not a victimless crime – our key amnesty is your chance to put things right

We've launched a campaign to ensure the people most in need aren’t denied the opportunity for a home as a result of tena...

-

News

Summer Event 2023

On Friday 4 August, over 80 residents came to enjoy the fun at the summer event, held by the Resident and Community Enga...

-

News

Why being a good neighbour is important for everyone

While we might not see our neighbours every day, it’s likely everyone will be aware of each other going about our daily ...

-

News

Free activities to do with children this summer in London

The school summer holidays are approaching, which is good news for teachers and kids but for parents it’s six weeks of k...

-

News

Summer resident event at Basil Jellicoe Hall has been rescheduled until Friday 4 August due to train

The Resident and Community Engagement Team are hosting two fun, family events this year. If you’re an Origin resident we...

-

Blog

Dear fellow residents: from first steps towards decarbonisation to advocate for the Origin approach?

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin management.Hi a...

-

News

We need your views on our Complains Booklet by 18 July

We have been working on a complaints booklet, to make sure we've got it right, we're asking for feedback so we can make ...

-

News

Upcoming summer events at The People's Museum in Camden

Here's a list of upcoming summer events at The People's Museum in CamdenMemories of Milk - 20 July 11am -1pm - locals in...

-

News

London Zoo is organising Inspiring Change – Designing an Eco-Campaign course for young people

London Zoo is organising Inspiring Change – Designing an Eco-Campaign course for young people aged 12 – 15 this summer!T...

-

Blog

Out and about with Carol

Annelle is working hard to provide a good service and our walkabout further reinforced the critical importance of listen...

-

News

We need your views on our draft Damp and Mould Policy by 10 July

We’ve been working on a newDamp and Mould Policy to make sure it serves our residents and your needs as well as possible...

-

News

Pam on van

This month our Director of Resident Services, Pam Bhamra joined Ben, from Gilmartins, on his van to shadow him on his mo...

-

News

Windrush 75 – Celebration and recognition

Over the last few years, Windrush has been a discussion point in politics and media. This is mainly due to the Hostile e...

-

News

The power of pronouns

Everyone has pronouns based on their gender identity, but it’s not always possible to know someone’s gender identity fro...

-

Blog

Out and about with Carol - June 2023

First off was Attenborough Court, a short hop across the road from Bushey Station. On site I met with Madalina Fieraru o...

-

News

Athlone Street Estate Repairs Day is on Friday 23 June

Our Estate Repairs Days are returning with our Repairs contractor Gilmartins. This is the first of many Repairs Days thi...

-

News

BBQ safety tips for the Summer months

We've put together some useful tips from the London Fire Brigade to help keep you safe if you choose to have a BBQ durin...

-

News

HouseProud Pledge

The HouseProud Pledge is a scheme that all social housing providers can sign up to. It asks them to demonstrate their co...

-

News

Happy Pride Month!

Happy Pride Month!We’re proud to celebrate the LGBTQI+ community’s right to love, respect, freedom and equality. 🌈To ce...

-

News

An update to our stock map, that shows how many homes we've got and where they are

Below you'll see our latest stock map that show our latest stock map to show how many homes we've got in our key local a...

-

News

Sharing stories and Information Day at People's Museum on 10 June

People’s Museum would like to invite you to their free Information Day on 10 June between 3pm – 5pm.If you live at St Ni...

-

News

Today, 6 June, our new Repairs Contract with Gilmartins goes live

This repairs contract covers around two-thirds of day-to-day repairs but excludes specialist services such as electrical...

-

News

We’re here to help when things go wrong

We know sometimes we don’t get things right and you may need to raise a complaint with us. If something has gone wrong o...

-

News

The latest Somers Town Community Newsletter - May

Take a look at the latest Somers Town Community Newsletter, covering topics like the new youth and community hub, volunt...

-

Blog

Be Part of the Solution, Spotlight's Sustainability Initiatives Need Your Help

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin management.Hell...

-

News

Local elections - Do not forget your photo ID!

Today on May 4, 2023, there will be local elections across the UK. The elections will take place in all areas of England...

-

Blog

Unlock NetZero survey

In partnership with a number of social housing providers, law firm Shakespeare Martineau has developed and launched an o...

-

News

'CONVOKER: Sound from South Camden' and other events at The People's Museum in Camden

'CONVOKER: Sound from South Camden' The People's Museum is hosting a May Day event by local artist Hannah Sawtell. 'CONV...

-

News

Emergency Alerts – how to manage your phone to stay safe if you are experiencing domestic abuse

On 23 April at 3pm there will be a national test of the Emergency Alerts service. The alerts will be used to let you kno...

-

Blog

National Housing Federation research finds 310,000 children in overcrowded homes forced to share a b

More than 310,000 children (313,244) in England are forced to share beds with other family members, due to severe overcr...

-

News

The new Emergency Alerts service is now live

The new Emergency Alert service is now live and as you might be aware, a national Emergency Alerts test will happen on S...

-

News

LIFT opportunities and events

Leading Inclusive Futures through Technology (LIFT) is a three year programme across Camden, Hackney, Islington and Towe...

-

Blog

Spotlight blog - April

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin managementHello...

-

News

Free activities to do with the kids during Easter holidays in London

From family workshop: My First Opera Experience, discovery days to playing with clay, here's the best family events and ...

-

News

Supporting Victims of Crime workshop

We are proud to say that we have funded Trauma Recovery Art Therapy Workshops organised by The Josh Hanson Trust, where ...

-

Blog

Financial support story

Our Financial Support Team are there to help residents with their finances and maximise any benefits they are entitled t...

-

News

Meet the Housing Ombudsman event on 30 March

Islington residents are invited to attend an event 30 March where you will be able to hear from the Housing Ombudsman. T...

-

News

Protecting the contents of your home – better to be safe than sorry

We’ve recently spoken with some of our residents who thought that as their landlord, we automatically insure their furni...

-

News

Universal Credit: reporting a change of rent

When we let you know about your rent changes, please do not report this until the actual date of that change. If it's do...

-

News

Ramadan Mubarak

Ramadan is one of the most significant events in the Islamic calendar, celebrated by Muslims around the world. In 2023, ...

-

News

Fuel Poverty Partnership lobby letter to the Mayor of London

Earlier this month, our Chief Executive, Carol Carter, signed a letter from the London Fuel Poverty Partnership to the m...

-

News

The latest Somers Town Community Newsletter - March 2023

Take a look at the latest Somers Town Community Newsletter, covering topics like reducing food waste, workshops and loca...

-

News

Staying safe in your kitchen

Fires are more likely to start in your kitchen than any other room in your home, we've put together some advice from the...

-

News

Happy International Women’s Day!

Happy International Women’s Day! The theme this year is #EmbraceEquity This is all about recognising the difference betw...

-

News

The latest HS2 Euston Station Newsletter

Take a look at the first HS2 Euston Station Newsletter in 2023, covering topics from Euston Road lane closures to utilit...

-

News

Camden Clean Air Action Plan 2023-26

Camden Council are launching the Camden Clean Air Action Plan 2023-26. They will be hosting a launch event on 10 March 2...

-

Blog

Supporting children through the cost of living crisis

Families across the country are feeling the pinch amid the cost-of-living crisis – and it’s affecting children’s wellbei...

-

News

Welcome to our new residents

On 27 February 2023, LandQ will be completing the sale of 152 properties across Camden and Islington to Origin. We have ...

-

News

A quick animation to tell you about the financial support we can offer our residents

We've put this quick animation together to highlight the financial support we offer our residents, check it out and get ...

-

News

We've made this quarter’s Best Companies lists

The results are in… We’re really pleased to have made it into this quarter’s Best Companies lists for: Top 50 large comp...

-

News

Housing Digital Innovation Awards - Best Digital Innovation Team winner

We are excited to announce we're this year’s Housing Innovation Award ‘Best Digital Innovation Team’ winners!In December...

-

Blog

Free activities to do with the kids this half term in London

From discovery days to playing with clay, here's the best family events and things to do for kids during February half t...

-

News

The Latest Somers Town Community Newsletter

Take a look at the latest Somers Town Community Newsletter, covering topics from reducing food waste to local events by ...

-

News

LGBT+ History Month 2023: Behind the Lens

It’s LGBT+ History Month, a month-long observance of lesbian, gay, bisexual, transgender and queer history, as well as a...

-

Blog

A New Year’s Message from the Sustainability Genie

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin management.Gree...

-

News

Get involved with our Repairs Contract Group

Following our comprehensive procurement process, which started with a consultation with our residents and colleagues at ...

-

Blog

Fake QR codes

Scammers are taking advantage of our trust in QR codes. A scammer could replace a genuine QR code with a fake one. For e...

-

News

A new 'garden in the sky' will link Camden Town to Kings Cross

We're excited to find out there will be a new 'garden in the sky' that will transform a section of disused railway betwe...

-

News

Our Resident Engagement work in Winter 2022/23

We recently sent out a newsletter from our Community Development Team with our rent statements. The update below outline...

-

News

A Space For Us Now news

Make 2023 meaningful...Become a Community CuratorVolunteer - help shape a museumWhat's coming up? Event on the 1980sWhat...

-

News

The latest Somers Town Community Newsletter - January 2023

Take a look at the latest Somers Town Community Newsletter, covering topics from reducing food waste to local events by ...

-

News

Help with living costs

If you’re struggling to afford the every day costs of living, please speak to your Neighbourhood Manager about our cost ...

-

News

Incident on Phoenix Road on Saturday

You may have seen the news over the weekend of a serious incident which took place around the corner from our main offic...

-

Blog

Seven tips for coping with the winter holiday blues

Today is Blue Monday, often called the saddest day of the year.The period after the winter holiday can often leave you f...

-

News

Christmas Gift Card Initiative 2022 22/12/2022

Instead of Christmas hampers, this year our Community Development Team decided to give residents referred by staff gift ...

-

Blog

Christmas Fire Safety: Tips & Advice

‘Tis the season to ensure festive fire safety. Many of the things we enjoy over the Christmas period, such as fairy ligh...

-

News

Repairs Contract update

We’re pleased to announce that following a comprehensive procurement process, which started with consultation with resid...

-

News

The work we've done to improve our response to damp and mould

We created a Damp and Mould Task Force early in 2022 following the Housing Ombudsman’s spotlight report on damp and moul...

-

Blog

A Visit to the Mothership

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin managementHello...

-

Blog

Spotlight Blogspot November 2022

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin managementHello...

-

News

Avoiding electrical fires – how to keep safe at home

From overloaded extension leads and cheap chargers, through to white goods not fit for the job, issues with electrical i...

-

News

Are you interested in shaping how we explain and present service charges?

We are looking for residents to be a part of our scrutiny group to look at how we explain and present service charges. T...

-

News

Come along to our FREE Winter Event for families

Please come and join us at our fun filled, free Winter Event for families on 26 November at Basil Jellicoe Hall, Drummon...

-

News

Fitch credit rating reaffirmed as A- with a stable outlook

Due to high inflation, higher interest rates, general economic prospects and the likelihood of a rent cap in 2023, it wi...

-

Blog

The importance of engaging with our residents: Derek’s story with Origin

We know how important engaging with our residents is, whether through resident engagement events, estate visits or one o...

-

News

LocalMotion Partnership

LocalMotion is a collaboration of six funders who want to play their part in facilitating systemic, positive change in s...

-

News

We need your views to help shape our new Resident Involvement Strategy!

We’re asking for your feedback and ideas about the ways we can improve how we involve our residents in shaping our servi...

-

News

Somers Town Future Neighbourhoods 2030

Helping Somers Town residents tackle the climate emergency and create a fairer future for everyone.Somers Town would lik...

-

News

The latest Somers Town Community Newsletter - November 2022

Take a look at the latest Somers Town Community Newsletter, covering topics from climate action day and stay warm days t...

-

Blog

Towards Net Zero: Preparing for our journey

Disclaimer- This is the independent Spotlight view. It does not necessarily represent the views of Origin managementHi a...

-

News

Diwali 2022: The significance of the festival of lights and happiness

Today, 24 October 2022, we celebrate the Festival of Lights, Diwali. It is a five-day-long celebration that commences wi...

-

News

October half-term activities for kids in London

October half-term is upon us! We’ve searched for some fun things to do with the kids in London this half term, so you do...

-

News

Our Annual Accounts 2021/22

We've done lots of work on our Annual Accounts document for 2021/22 to make sure they are easy to follow and well design...

-

Blog

The Support Hub - New Service

Over the last nine months our Care and Support team have been developing a new pilot to deliver a service for our reside...

-

News

Cost of living support

Millions of people across the UK are struggling to cover their essential household costs nowadays. The 'cost of living c...

-

News

Black History Month 2022

As we start Black History Month 2022, we love the Time for Change: Action Not Word theme chosen by blackhistorymonth.org...

-

News

Resident Voice Index Survey

The Resident Voice Index™ has just launched its latest survey, titled ‘Cost of Living: Crunch time’and we would love you...

-

News

PlaceShapers update on the cost of living campaign

Petition hand in: Thursday 22 September 2022PlaceShapers is part of 70 organisations calling on the Government to fix th...

-

News

Energy Price Cap Update

The government recently announced their plan to replace the Ofgem price cap by the government’s own Energy Price Guarant...

-

Blog

What Might ‘Sustainability’ Mean?

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin management.Welc...

-

News

Death of Her Majesty Queen Elizabeth II

We are saddened to hear of the death of Her Majesty, Queen Elizabeth II. A lifetime of service to the United Kingdom, th...

-

News

British Library Family Day: Festival of Books - September 2022

British Library is organising a Family Day: Festival of Books on 24 September from 12.00 - 16.00. Join them for this fun...

-

News

The latest Somers Town Community Newsletter September 2022

Take a look at the latest Somers Town Community Newsletter, covering topics from reducing food waste to local events by ...

-

News

Update to parking form

We have updated our parking form so that you can request to exempt a vehicle to be able to park in your area for a reaso...

-

Blog

Let's work together to respond to the climate emergency

Disclaimer-This is the independent Spotlight view. It does not necessarily represent the views of Origin management.Hi f...

-

News

Camden Inspire begins on Friday 2 September

What is Camden Inspire? The brainchild of Camden Town Unlimited, an organisation that represents businesses and aims to ...

-

News

Our Spotlight Panel's 12 month workplan and why your views are important to us

No one knows better what it’s like to live in your home and neighbourhood than you, our residents who live there 24/7. W...

-

News

Help for Households - cost of living support from the Government

We know people are worried about rising goods and energy prices, inflation and cost of living pressures, so the governme...

-

News

What have we been up to this summer?

On 16 July 2022, we held our summer resident engagement event at Basil Jellicoe Hall in Somers Town, Camden. We had a gr...

-

News

As a result of the rail and bus strikes our Estate Services - bin collections, caretaking and garden

As a result of the rail and bus strikes our Estate Services - bin collections, caretaking and gardening will be reduced ...

-

News

Fire Safety Advice – Hot Weather

With the hot weather we're currently experiencing, our gardens will be very dry and with that, the risk of fire will inc...

-

News

Camden Inspire 2022

Camden Inspire is back again this year on 2-3 September - midday-10pm.They are yet again taking over Buck Street and Stu...

-

News

Carbon Literacy Tenant Pathway

The Carbon Literacy Project are hosting a Kick-off meeting for the development of the Tenant Pathway of the Social Housi...

-

News

Hertfordshire Pop-Up event, Blakeney Road in Stevenage

Come and join us at our Hertfordshire Pop-Up event on Blakeney Road in Stevenage on Wednesday 17 August 2022 between 3 -...

-

Blog

Update on Building Digital UK

We asked Peter Butler (our Business Development Manager) about our response to Building Digital UK:What is Building Digi...

-

News

We would love your feedback as part of our Consumer Standards Resident Consultation

All Social Landlords are regulated by the Regulator of Social Housing who set out the way in which we must deliver servi...

-

News

Free family activities in London this summer

With schools closed across the country for the summer holidays, keeping little (and big) ones occupied without breaking ...

-

News

Heatwave - Heightened Fire Risk

With the continued extremely hot and dry weather, which we are experiencing currently, there is a greater risk of inadve...

-

News

We’re signing up to the HouseProud Pledge, to recognise and support our work with LGBTQ+ involved re

We’re signing up to the HouseProud Pledge, to recognise and support our work with LGBTQ+ involved residents HouseProud w...

-

News

Cost of living payments from the Government

There are three different cost of living payments: The main cost of living payment, worth £650 in total, is for those ...

-

Blog

Introducing our new guest blog from the Spotlight Panel made up of nine Origin residents

Striving Towards a New Repairs Contract Welcome Origin residents to a regular post from one of the nine Spotlight member...

-

News

Save the date for our Hertfordshire Pop-Up Resident Engagement Event in Stevenage!

Register your interest and save the date! Come and join us on Wednesday 17 August 2022 between 3 - 6pm at Blakeney House...

-

News

Employment & training service turned the tide for an unemployed resident

Juvan was referred to the service in March 2022 by his Supported Housing Officer. He had recently lost his job and neede...

-

News

Estate Repairs Days - coming to your area soon

We’d like to invite you along to one of our Repairs Estate Days. The first is on on Friday 24 June in Somers Town. We wi...

-

News

You are invited to our free summer event for families on Saturday 16 July

Please come and join us at our fun filled, free Summer Event for families on 16 July at Basil Jellicoe Hall, Drummond Cr...

-

News

We have been shortlisted for the Inside Housing Development Awards 2022

Our popular Harrow One development in partnership with Hill Group UK has been shortlisted for ‘Best Partnership - over 1...

-

News

Queen's Platinum Jubilee celebration at Rose Bush Court and Ashton Court

Back in April, we launched our Community Fund for The Big Jubilee Lunch celebrating Queen's Platinum Jubilee in June - a...

-

News

Parking consultation

If you have parking enforcement in your area you will receive our Parking Consultation via email and/or letter from toda...

-

News

Grenfell Tower - fifth anniversary

Remembering Grenfell Five years on from the Grenfell disaster when 72 people lost their lives and many more were injured...

-

News

We need your views on our draft Repairs Policy by Monday 20 June

We’ve been working on a newRepairs Policy to make sure it serves our residents and your needs as well as possible. We kn...

-

News

Right to Buy scheme announced by the Government on 8 June

On 8 June Boris Johnson announced his plans to boost home ownership in England. The plan includes extending the Governme...

-

News

Monkeypox advice

As we have been hearing about monkeypox a lot in recent weeks, we wanted to provide you with more information about the ...

-

Blog

When money's tight, how can we look after our family and the environment too?

Greetings from your Climate Change Champions on Origin’s Spotlight Panel. The Spotlight panel meet every three months to...

-

Blog

Local summer events with A Space For Us

They describe the Museum space as 'The People’s Museum Somers Town: A Space for Us is a space to celebrate Somers Town’s...

-

News

Help with the cost of living

Chancellor Rishi Sunak has delivered a statement in the House of Commons outlining the Government's plans to support peo...

-

News

Coronavirus update

At a recent Covid Planning meeting we agreed it is the right time to lift covid-related measures in our offices, and her...

-

News

A guide to asbestos in your home

We've put together a handy guide to ensure you're safe in your home around any potential hazards from asbestos, Just fol...

-

News

Asbestos in your home guide

We've put together a handy guide to ensure you're safe in your home around any potential hazards from asbestos, Just fol...

-

News

Parking update - April 2022

Parking Ticketing Limited (PTL), one of the companies that operates some of our car parking areas is now named BaySentry...

-

News

Our Spotlight Panel Needs You

Our Spotlight Panel is made up of residents who works closely with us to review our performance and hold Origin accounta...

-

News

Spotlight Panel Needs You

Our Spotlight Panel is made up of residents who works closely with us to review our performance and hold Origin accounta...

-

News

A look at the Spring budget and what it means

There were some changes in the budget aimed at making the rising cost of living easier on people across the country.A ye...

-

News

Universal Credit: reporting a change of rent 2022

When we let you know about your rent changes, please do not report this until the actual date of that change. If it's do...

-

Blog

Charging e-bikes and e-scooters safely

E-bikes and e-scooters are becoming more popular and most are powered by lithium-ion batteries which can be charged in t...

-

News

We currently have a staff shortage in our Home Ownership Team, which means we won’t be able to deal

We currently have a staff shortage in our Home Ownership Team, which means we won’t be able to deal with your enquiries ...

-

News

Homes for Ukraine

We have worked with volunteer groups in the recent past to secure accommodation for refugees and we are currently lookin...

-

News

Ukraine crisis: how you can help

Global charities operating in the UK and Ukraine are appealing for funds to offer aid in the humanitarian crisis. The B...

-

News

An update on our parking review

The Scrutiny group has reviewed our Parking Policy and have suggested their recommendations for improvements. From these...

-

News

2020/21 Service Charge Audited Accounts Update

2020/21 Service Charge Accounts Update: We have a delay with our audit partners and we are still working with them to fi...

-

Blog

Understanding your credit score

National Credit Education Month was founded to increase awareness about the importance of building a positive credit pro...

-

News

Our response to Storm Eunice

Without knowing what the severity would be and the impact on our residents and colleagues, here is a quick overview of h...

-

News

Coronavirus update 21 February 2022

Yesterday, the Government unveiled it’s "living with Covid" plan. This means that: From 21 February: the government is d...

-

News

Rent and service charges - how we can help

We know that times are tough for many of our residents, and we realise that an increase in rents and service charges is ...

-

News

Storm Eunice

The Met Office has issued a Red weather warning for London effective between 10am-3pm on Friday, 18 February 2022. This ...

-

News

Housing Digital Innovation Awards - Best Online Service winner

In October 2020, we launched Basil Bot – a state-of-the-art chatbot, which has transformed our customer service offer in...

-

News

We need your views! We’re running a focus group for our residents on tenant satisfaction measures

The Regulator of Social Housing is looking for views on its proposals for tenant satisfaction measures which are part of...

-

News

A Q&A with former apprentice Sulejman, to support National Apprenticeship Week #NAW2022

It’s National Apprenticeship Week from 7-14 February, to support #NAW2022 we’ve spoken to some of our apprentices about ...

-

News

Repairs Roadshow – feedback and updates

We would like to thank everyone who took time to respond to our survey on repairs to help inform how we procure and mana...

-

Blog

Find out more about our £2000 funding to HSO to support young people in Bushey

We recently awarded Herts Schools Outreach, a Hertfordshire charity supporting children and young people, with £2000 fro...

-

News

National Storytelling Week

Storytelling is an ancient form of passing on knowledge for survival, education and recreational purposes, which is why ...

-

News

Holocaust Memorial Day

The Holocaust Memorial Day (HMD) on 27 January remembers the six million Jews murdered during the Holocaust, alongside t...

-

News

Up to 7 million missing out on benefits they're entitled to - are you?

Up to seven million people in the UK are missing out on benefits they're entitled to, according to MSE founder Martin Le...

-

News

Have your say on how social housing landlords measure tenant satisfaction

Consultation on the introduction of tenant satisfaction measuresThe Regulator of Social Housing is looking for views on ...

-

News

Changes to parking charges

Following a recent review of our parking policy we have stopped charges for parking bays.All charges have been stopped f...

-

News

Government announcement on building safety and cladding costs for leaseholders in medium rise buildings

Here we explain the recent Government announcement on building safety and what it means for you, as far as we can tell f...

-

Blog

12 best ways to save money

With food and utility bills going up, we thought it would be a good idea to share some money-saving ideas. From cancelli...

-

News

Self isolation changes to five days

The first test must be taken no earlier than day five of the self-isolation period, and the second must be taken the fol...

-

News

Apply now for our latest round of Community Funding - closing on 31 January 2022

We launched our community fund in 2020 to support our communities in London and Hertfordshire. This fund is invested int...

-

Blog

A Guide to Condensation and How to Reduce It

What is condensation? Even though you can’t see it, the air in and around your home contains water vapour. The warmer th...

-

Blog

Dance classes for girls and young women in Barnet

Our community fund has grants of up to £2,000 available to bring community projects, events or activities to life and Yo...

-

Blog

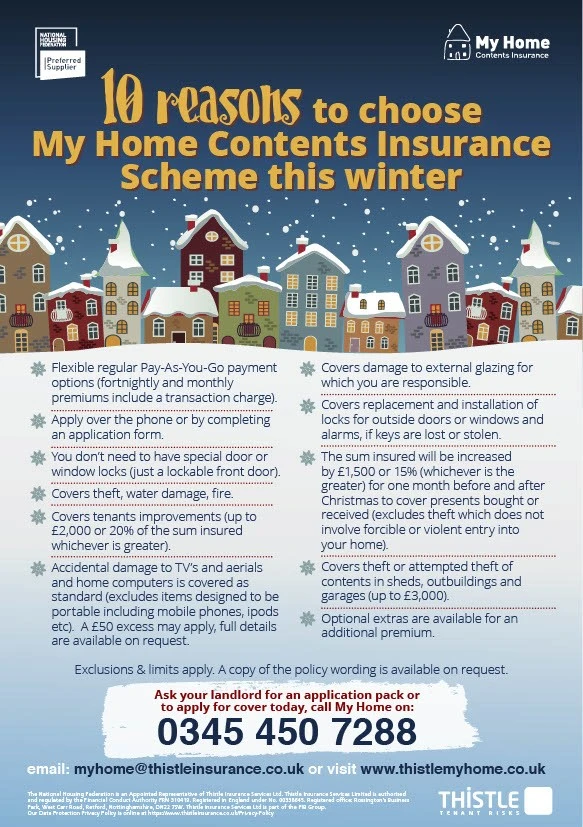

10 reasons to choose My Home Contents Scheme this winter

If you are renting the property you live in, it's a good idea to consider having contents insurance, which is designed t...

-

News

Candle safety in your home

With the days growing darker and winter setting in, a few candles scattered around the room can add a warm glow to your ...

-

News

The Somers Town Community Hub is now open

Somers Town Community Association and Camden Mobile Food Bank have opened their new joint venture; The Somers Town Commu...

-

News

Fire safety during the festive season

We hope you all have a great festive season this year. To make sure you and your families are as safe as possible it’s b...

-

News

A new scheme for young people in partnership with New Horizon Youth Centre

In our second partnership with New Horizon Youth Centre, we've have launched Project 62, a scheme for formerly homeless ...

-

News

A new scheme for young people in partnership with New Horizon Youth Centre (1)

In our second partnership with New Horizon Youth Centre, we have launched Project 62, a scheme for formerly homeless you...

-

News

Summer safety tips

Barbeques – never light a barbeque on your balcony. They can cause fires to start when falling embers burn items on the ...

-

News

Our Tpas membership

We are now proud members of Tpas, England’s leading resident engagement experts! Tpas promote excellence in resident inv...

-

News

Ashton Court redevelopment

Corridors at Ashton Court and inside Sue's newly remodelled flat. Ashton Court is our newly redeveloped retirement sch...

-

News

How to improve your financial well-being

This week is the Money and Pensions Service’s Talk Money week. The aim of the week is to break the stigma that surrounds...

-

News

Housing Day 2019: a look at our origins

In celebration of Housing Day 2019, we want to share with you the history behind Origin. Our founder Basil Jellicoe form...

-

News

World Homelessness Day 2019: New Horizon Youth Centre's takeover of King's Cross

Ahead of World Homelessness Day on Thursday, last week we were joined by Claire, Dean and Holly from New Horizon Youth C...

-

Blog

Summer parties for our service users in London and Hertfordshire

On Wednesday 4 September, our Learning Disabilities Team organised our seventh annual summer party for London service us...

-

Blog

We are taking part in Starts at Home Day 2019

Today we are taking part in Starts at Home Day. Starts at Home Day celebrates the positive impact that supported housin...

-

News

101 year old resident reunited with military service medals

On Thursday 15 August one of our residents living at Pennethorne House was awarded with a new set of war medals by the M...

-

News

Our summer BBQ at Enfield Single Housing

On Friday 16 August, we had a summer BBQ at Swan House with our Enfield Single Housing residents. This year's BBQ was a...

-

Blog

Our residents' trip to Chessington World of Adventures

We visited Chessington with our residents for a fun day of going on rides and visiting the zoo. On Friday 16 August we ...

-

Blog

Our partnership with Settle

We've been working with Settle since 2015 to support 10 vulnerable and formerly homeless young people per year at Enfiel...

-

News

Gardening at Swan House in Enfield

Last week, residents and our Grounds Maintenance Contractor John O'Conner joined us to replant the gardens at Swan House...

-

Blog

Fire risk on balconies

In recent years there have been a number of serious fires on the balconies of homes across the country. Fire risk on bal...

-

Blog

Tips for dealing with rats and mice from our Pest Control Officer

Our Pest Control Officer Daniel Hogan shared some simple tips on how you can manage mice and rats. We visited a kitchen ...

-

Blog

Celebrating the one year anniversary of Project 99

Over the last year Project 99 has offered much-needed affordable housing and support to 13 young people that were former...

-

News

Remembering Henry Croft: the Original Pearly King

We joined the Pearlies of Kings Cross and St Pancras to dedicate a plaque to Henry Croft, who lived at 15 Charles Road ...

-

Blog

Meet Fiona, our Floating Support Worker

We met with Fiona to find out more about the work she does in North Hertfordshire and Stevenage to support people with l...

-

News

What to do if you suspect a gas leak

Our Customer Resolution Team have had some calls recently to report a gas leak to us, it is quicker and safer for you to...

-

Blog

Our gardening project at Athlone Estate

We're running a gardening project every two weeks with Groundwork London for our residents in Athlone Estate. In the fir...

-

News

Rose Bush Court wins Regional Bronze Award

We’re delighted to have been recognised in the Elderly Accommodation Counsel (EAC) awards which celebrate housing for la...

-

Blog

Success at national cooking competition

One of our residents living in supported housing for younger people, Humayun, won the 2019 Dolmio Professional and Uncle...

-

Blog

Clearing fly tips with our Caretaking Team

Fly-tips are piles of rubbish and bulk items like furniture and building rubble left illegally outside buildings and on ...

-

News

Keir Starmer MP visits Project 99

Last week we were delighted to host Keir Starmer MP on a visit to Project 99 – a joint venture between us and our partne...

-

News

We've been awarded with an Autism Accreditation

We are delighted that we have been awarded an Accredited status by the Autism Award Committee from the National Autism S...

-

Blog

We Care Day

Placeshapers is a network of community-focused housing associations we're part of. Together we have 900,000 homes for re...

-

News

Bright futures for young people at Project 99

Back in April of this year, we launched Project 99 together with New Horizon Youth Centre (NHYC), in our first partnersh...

-

Blog

What a difference the right support has made

We speak to Steven and his Support Worker Carlos, to find out the difference living at Speedwell Court has made to him. ...

-

News

A day in the life of an Estate Inspector: Tony

Ever wondered what it's like to be an Estate Inspector? Meet Tony, part of our team of Estate Inspectors. We spent the d...

-

Blog

Smiles all round at Athlone Estate’s summer celebration

Last Friday afternoon local residents came together for a party at our Athlone Estate in Kentish Town to celebrate the g...

-

News

Older Somers Town residents get creative through storytelling workshops

Members of our older people project We Are Ageing Better took part in The Liminal Space’s Pivots and tales animation wor...

-

Blog

Protect yourself against fire risk this summer

In hot, dry weather like we have experienced lately, it’s important to be careful when it comes to the risk of fire. Aft...

-

Blog

A day in the life of an Adaptations Co-ordinator

Ever wondered how to go about adapting your home? Richard is our Adaptations Co-ordinator and we joined him for a day to...

-

News

Gardening galore in Enfield in partnership with Together We Create

Local charity Together We Create (TWC) runs innovative projects to help build strong communities. We’ve partnered with T...

-

Blog

Stonewall Housing's weekly drop-in

I’m Nick, and I work for Stonewall Housing. For several years now, we have been fortunate to have the use of one of the ...

-

News

Tackling homelessness together

The homelessness crisis continues to be a high-priority concern in our country and, as a registered social landlord, we’...

-

News

It’s official – we’re a London Healthy Workplace

The Healthy Workplace Charter, backed by the Mayor of London, is a framework that supports and recognises organisations...

-

Blog

Meet Greta: social care student and volunteering mega-fan

We met up with Greta to hear about her experience volunteering in one of our local communities. She’s a social care stud...

-

Blog

Dennis's story: from homelessness to success in Ponders End community

Today Dennis, 44 years old, is chatting freely and cheerily about community life in Ponders End in Enfield and all the e...

-

Blog

Shared housing for young people in Enfield

Over the last six months, Alev (Head of Housing) and I have been speaking about our young people housing in Enfield at ...

-

News

Keeping your home safe this Autumn and Winter

As National Home Security Month draws to an end, we thought it’d be useful to gather some top tips and advice on how to ...

-

Blog

How support has changed lives

In our Enfield housing, we have provided tailored support for around 55 residents covering issues such as mental health,...

-

Blog

We’re making changes in how we deliver customer service

We’re investing in improving our customer services and processes to ensure that we deliver great service by doing the ri...

-

Blog

First a Level 2 qualification, then onwards and upwards for Dom

I first met Dom when he came into our Enfield Employment Hub, then based in Ponders End. He was living locally, and had ...

-

Blog

Practice makes perfect: tackling mental health and unemployment

Over the past five months, I have been working on the frontline as an employment support worker at Origin Housing. As pa...

-

News

How to Avoid Carbon Monoxide Poisoning?

Carbon monoxide is a noxious gas that gets produced when fuels such as gas, oil, coal or wood don't burn fully. Carbon m...

-

Blog

Origin Leads with the Digital Inclusion Project

Digital skills are a must in the tech-obsessed 21st century and Origin is making sure that no resident is left behind. O...

-

Blog

Formal Opening of the Young People’s Service in Camden

Following a soft-launch earlier this year, Friday 14 October saw the formal opening of Origin's Young People's Service i...

-

News

Origin Housing staff volunteer in the local community

There isn’t much Origin’s Housing Services team didn’t cover on their annual away day, from clearing rubbish in a park a...

-

Blog

New Young People service in Camden

We have been looking at innovative ways to continue to support vulnerable young people by assessing our assets to maximi...

-

Blog

Helping Enfield residents get back into work

Over the last financial year, we’ve helped 39 people get back into work and a majority of these people visited our emplo...